Category

Level

Price

Language

Rating

12 Courses are found

Beginner

Beginner

Certificate in Ethical Hacking

The Certificate in Ethical Hacking is a foundational program designed to provide learners with a comprehensive understan...

Beginner

Beginner

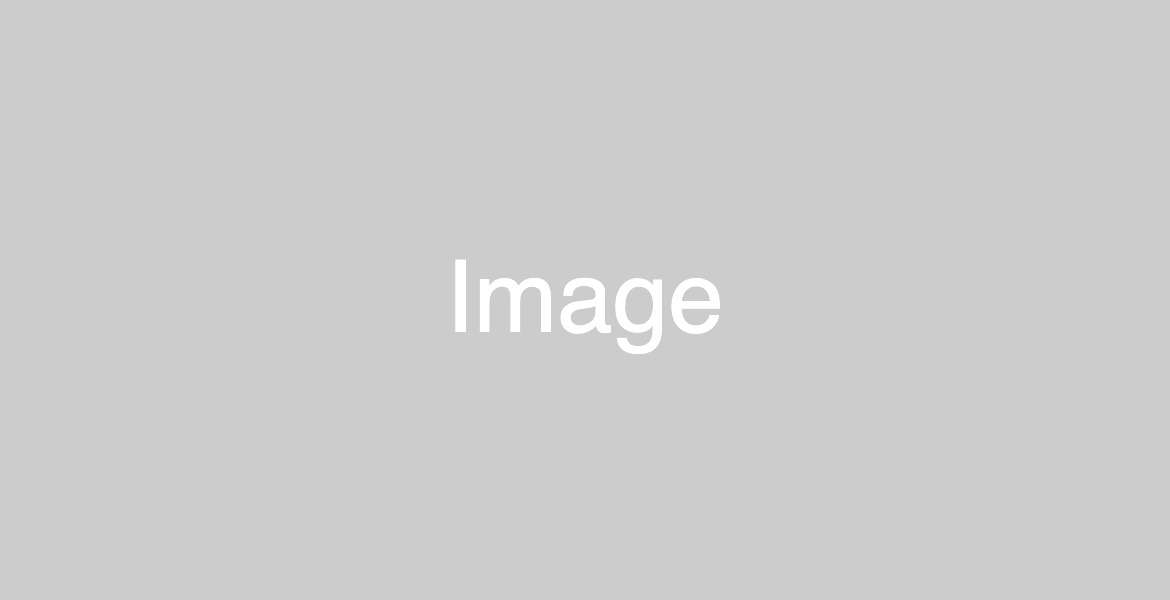

CERTIFICATE COURSE IN FILM APPRECIATION

ObjectivesTo introduce students to cinema as an art form, storyteller, and cultural artifactTo foster the ability to dec...

Beginner

Beginner

MASTERING SOFT SKILLS

The Department of History is proud to offer an offline Certificate Course in Soft Skills, designed to equip learners wit...

Beginner

Beginner

Gym Trainer/Instructor

This course provides a comprehensive introduction to the principles and practices of gym training through a balanced com...

Intermediate

Intermediate

Essential for Life Skills Education

Course overviewEssential Life skill education is a unique and effective programme which enablesindividuals to adopt and...

Beginner

Beginner

Visual AI Content Generation

Visual AI Content Generation is a beginner-friendly certificate course that focuses on how to thoughtfully use AI as a c...

Beginner

Beginner

WORKPLACE CIVILITY AND INTELLIGENCE

This certificate course is designed to help students develop the social, emotional, and professional skills required to...

Beginner

Beginner

INTERNATIONAL BUSINESS

This course, " INTERNATIONAL BUSINESS," offers students a comprehensive exploration of economic diplomacy. Over 30 hours...

Beginner

Beginner

New Product Development in the Food Industry: From Concept to Commercialization (with Entrepreneurship & Startup Essentials

The Certificate Course on New Product Development in the Food Industry: From Concept to Commercialization (with Entrepre...

Beginner

Beginner

Hindi Tranlsation

Course Code : LC7GUCE140 aहिंदी विभाग, संत. अलोशियस (मानित विश्वविद्यालय) मंगळूरु, हिंदी में अनुवाद सर्टिफ़िकेट कोर्स(Ce...

Beginner

Beginner

Better English for Effective Communication

MODULE I: BETTER PRONUNCIATION (15 Hours)1. Introduction to 44 sounds of English through IPA script (3 hrs) 2. Word acc...